How is the market doing?

Off to a great start…

We’re halfway through this year already and so far, so good. Global markets advanced in June following slightly better than anticipated inflation data. And as you can see by the chart below, the U.S. stock market is off to a great start. The promise of greater efficiencies from the various AI initiatives continues to inspire investors and technology, communication services and utilities were in the forefront of performance even as other, less dynamic areas like materials and industrial companies brought up the rear. This has continued a pattern of strong performance by tech and communications companies in general since the market selloff that ended in October of 2022.

This continued outperformance by tech companies has resulted in a large percentage of the S&P 500 being comprised of a small number of large companies. The “Magnificent Seven”, Microsoft, Apple, Tesla, Meta, Nvidia and Alphabet combined represent a bit over a third of the value of the S&P 500 and have contributed the lion’s share of the performance of that index over the year.

In the displayed charts, the following exchange-traded fund data has been used as a proxy for index performance. "U.S. Bonds" by iShares Core U.S. Aggregate Bond ETF (Ticker: AGG). "U.S. Stocks" by SPDR S&P 500 ETF (Ticker: SPY). "Foreign Stocks" by iShares MSCI EAFE ETF (Ticker: EFA). Source: Yahoo! Finance, FocusPoint Solutions calculations.

It may be time for a change…

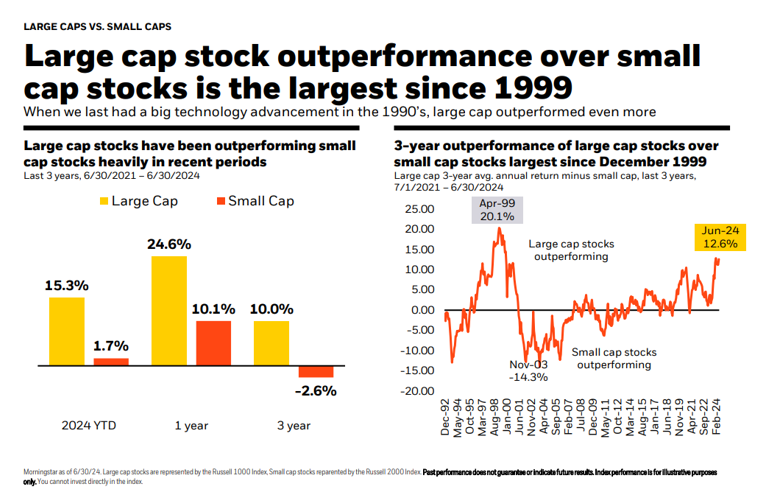

The infographic below shows how much Large U.S. companies have outperformed smaller companies lately. However, over the past week, we started to see this performance rotate and small companies have gone on a winning streak while large cap tech sold off.

Source: Blackrock Student of the Market July 2024

Return of the “Trump Trade”…

This last week also saw a bit of action in market performance from news headlines. With the volatile political climate that we have seen over the last few weeks, Wall Street began to make bets on a second Trump presidency. This means that we saw intermediate treasury yields rise in expectation of higher deficits from increased spending and tax cuts. Also, an expectation of tariffs and tough trade policy has contributed to selling tech and chip stocks in favor of cyclical sectors like energy and financials (Biden’s comments on being tougher on China have contributed to this as well). The Republican platform expressed support for crypto and opposition to crypto regulation which has given Bitcoin a boost.

Please keep in mind that much of this is reactionary and not based on fundamentals. In the long-term, the markets have cared very little about who is in the presidency and have actually performed the best when there is a divided leadership among the executive and legislative branches. We always recommend “staying centered” with your investments and avoid making emotional bets. In the long term a well-balanced portfolio will be more effective for reaching your financial goals. See below for some interesting facts about market performance.

Source: Blackrock MidYear Market Outlookt July 2024

Source: Blackrock Midyear Market Outlook July 2024

What’s up with the economy?

Continued economic growth…

At quarter-end, the overall signal from recession-indicators improved from cautionary in the previous quarter to economic expansion which means continued improvement toward an economic “soft-landing” and avoiding a recession. Company earnings growth remains stronger than what was expected earlier in the year. Assuming that a recession is avoided, and even if a minor recession were to ultimately unfold, expectations for 2024 and 2025 remain robust.

Source: FPS Monthly Advisor Meeting July 2024

It may be time to ease off the brakes…

Although job creation in the U.S. was higher than expected in May, a continued rise in the U.S. unemployment rate coupled with a decline in the U.S. labor participation rate, led investors to conclude that the long-term impact of the Fed’s restrictive monetary policy is beginning to take some momentum out of the U.S. labor market.

We’ve started to see some weakness in consumer spending, especially from the lower income cohort.

Manufacturing is showing continued weakness

Services just moved into contraction

Source: Blackrock Midyear Market Outlook July 2024

All of these weaking economic indicators combined with a moderation in inflation has led analysts to believe that an interest rate cut is coming sooner rather than later, and we may possibly see two rate cuts in 2024 now.

Keep in mind that rate cuts typically translate into easier financial conditions and a boost to economic growth and corporate earnings. On the personal side, it could mean that we see lower interest rates on cash but also lower rates on loans.

Please reach out to us with your investing questions

We are here for you! Please let us know if you have any investing or financial planning questions we can help with.

Sources for this material were taken from:

Blackrock’s Mid Year Market Outlook July 2024

Blackrock’s Student of the Market July 2024

Focus Point Solutions Monthly Advisor Meeting Presentation July 2024

Centered Financial, LLC is a registered investment adviser offering advisory services in the State of California, Utah, Texas and in other jurisdictions where exempted. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. There is no assurance that the techniques, strategies, or investments discussed are suitable for all investors or will yield positive outcomes. To determine which strategies or investment(s) may be appropriate for you, consult your financial adviser prior to investing. Any discussion of strategies related to tax or legal planning is general and is not intended as tax or legal advice. Please consult appropriate tax and legal professionals for recommendations pertaining to your specific situation.

Comments